Surge in Online Shopping Activities Boosts Virtual Payments, Results in Increased Demand for Payment Processing Solutions

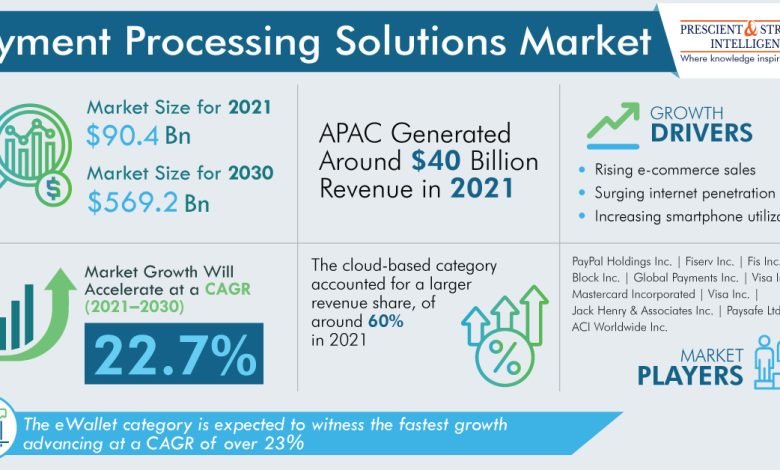

These major key drivers in the global payment processing solutions market are the rising utilization of smartphones, increasing internet penetration, and surging e-commerce sales. In 2021, the market was valued at $90.4 billion, and it is projected to touch $569.2 billion in 2030, advancing at a 22.7% CAGR from 2021 to 2030. Furthermore, greater integration of varied payment solutions by all the types of enterprises, such as mobile applications, e-wallets, and cards will augment growth in this market.

Under the segment of payment method, the e-wallet category will dominate the payment processing solutions market, and it is predicted to grow at a CAGR of 23% from 2021 to 2030. This can be credited to the greater deployment of e-wallets due to the rising penetration of smartphones and laptops all around the world. More than 80% of the population owned a smartphone in 2022, which accounts for about 6 billion of the total world population. The increasing investments, coupled with a rising count of e-commerce platforms will also propel growth in this category.

Read Full Report: Payment Processing Solutions Market Revenue Estimation and Growth Forecast Report

Based on deployment, the payment processing solutions market is bifurcated into cloud-based and on-premises. The cloud-based category ruled the market by generating higher revenue, accounting for about 60% of the total market revenue. This is on account of various advantageous features provided by this category over the on-premises category including better scaling, swift speed, extensive security, and full-time deployment. Moreover, the risk-averse property associated with the economic costs of this category accounts for the market growth. The outbreak of COVID-19 had further pushed the demand for these solutions with a dire need for contactless payments.

The BFSI category is projected to hold the largest share in the payment processing solutions market, accounting for one-fourth of the end use segment share in 2030. By making the banking process convenient and swift, and removing extensive paperwork, there is a high use of these solutions in the finance and banking industry. Furthermore, they offer payroll processing, liquidity management, and easy online transactions such as payments and transfers. Moreover, the popularity of advanced payment processing solutions among banks and fintech firms will propel market growth.

Surge in Online Shopping Activities Boosts Virtual Payments, Results in Increased Demand for Payment Processing Solutions

Another major driver in the payment processing solutions market is extensive government support. Several initiatives and favorable policies undertaken by the government will allow the market players to gain a competitive edge in this digitalized era. For instance, a partnership with Mastercard Incorporated was announced by a cloud banking network named Temenos AG to permit the bank to accelerate its integration of the services of request-to-pay in the U.K. Furthermore, these acquisitions will swift, enhance, and economize the adoption of these services.

The highest revenue in the payment processing solutions market was generated by APAC in 2021, accounting for approximately $40 billion. The market will continue this trend, exhibiting the highest CAGR in the forecast period owing to greater adoption of e-wallets and cards, surging internet services, and rising smartphones use. All of this goes hand in hand with enhanced government support in these countries and a skyrocketing count of daily transactions in countries such as South Korea, China, and India further augmenting the APAC market growth.

Hence, rising e-commerce sales and surging internet penetration will create lucrative opportunities for the market players to remain highly competitive.

How Do Online Payment Processing Solutions Provide Convenience to Merchants?

The surge in online shopping creates a huge demand for instant payment processing. Numerous traveling websites allow people to book tickets online, processing the payment in the virtual mode. Similarly, people can recharge their metro cards on various apps, such as PhonePe, Paytm, Google Pay, and Amazon Pay. Moreover, tourists can book hotels, transportation, and other facilities online and make payments from credit/debit cards, internet banking, and digital wallets, using instant payment processing solutions.

The funds from the buyer’s account are validated by the payment processors, no matter which payment mode is selected. These programs connect with merchants through virtual terminals, to accept the payment and manage the whole online transaction process with customers, banks, online merchants, and card networks. Outside India, the top payment processing solutions are Authorize.net, Checkout.com, GoCardless, BlueSnap, WePay, PayPal, Stripe, and Braintree.

Among these, the most-widely used payment processing solution is PayPal, catering to businesses of all sizes, scales, and industries. It offers various tools to function and scale growth, facilitating customers with making payments from anywhere. Similarly, WePay, powered by JP Morgan Chase, offers a strong application programming interface. Sellers with a Chase account can quickly receive payouts on the same day, without additional cost.

Need for Efficient Payment Processing Solutions among E-Commerce Sites

The online payments mode offers convenience while ordering products and services, donating, registering for webinars, and in many other activities. Within the comfort of their home, customers can quickly make payments without any hassle. It minimizes the effort to visit the physical space and then make payments. This is the key reason the share of e-commerce in total retail sales jumped by 3% between 2019 and 2020, as per the UNCTAD.

However, sellers in the e-commerce sector can be sidelined, no matter how outstanding the products or services they offer, due to the constraints in payment processing. Companies that run operations worldwide need a standard solution to process online payments, which would be a key factor behind the growth of the payment processing solutions market to almost $570 billion by 2030.

Major Payment Methods

Debit Cards: Payments are widely processed through debit cards worldwide, whether it is at the pump or in-store after shopping. They are now gaining even more traction than before due to the additional advancements that facilitate immediate processing of funds to merchants, without any risk. The newer and advanced types of debit cards are PIN, PINless, and contactless cards.

Credit Cards: Making purchases through credit cards is an ever-burgeoning trend. Around 80% of the consumers prefer credit cards instead of cash to purchase products and services. It can become quite tough for new e-commerce businesses to select the right payment processor, as it has a significant impact on operations. The top credit card payment processing solutions are Clover, ProMerchant, Chase Paymentech, Payment Depot, Helcim, National Processing, Paysafe, Stripe, and Square.

Here Are the Top Payment Processing Solutions for 2022

E-Wallet: E-wallets, including Google Pay, Amazon Pay, and PayPal, are used for the same purpose as credit and debit cards, as they are linked with the person’s bank account. Presently, they are used widely for everyday purchases, such as groceries, tickets, and even medicines. An e-wallet requires a PIN to process payments.

UPI: The RBI encourages UPI as it has the potential to process 100 crore transactions a day. UPI transactions are processed directly from bank to bank, utilizing virtual payment identities and addresses. It has a maximum transaction limit of up to INR 2 lakh at a time. Customers without a KYC can make payments of up to INR 10,000 in a month. Popular UPI applications are MobiKwik, Amazon Pay, BHIM, Samsung Pay, Paytm, and WhatsApp Pay.

Therefore, the demand for payment processing solutions is going to rise due to the surge in online shopping activities, itself due to the convenience facilitated by virtual payment modes while purchasing items from the comfort of the home or on the go.